Investing in a 401(k) plan is one of the most common methods used to build a secure retirement. Many people have enjoyed long and comfortable retirements by planning well with this retirement plan, by starting to save early in life and maximizing their employer’s contribution. However, while owning a 401k for long periods of time, crises and outliers can occur in the stock market that can make investors in these accounts very nervous.

Here we offer you five recommendations on what to do to maximize your investment in times of crisis.

1. Keep calm

The most important thing of all, in any crisis, is to remain calm. When we act motivated by fear and stress, we usually do not make the best decisions, therefore, it is important to remain calm to make decisions in the most analytical way possible.

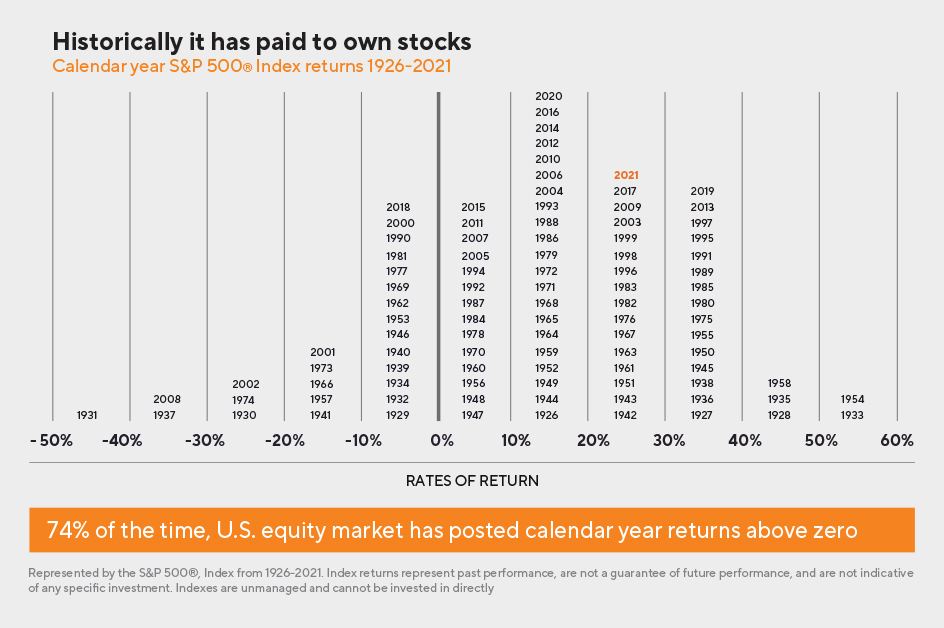

If we look at the stock market in a historical context we can see (insert graph – see below) that between 1926 and 2021 the market has grown 74 percent of the time and has decreased 26 percent of the time. Therefore, the stock market, although it sometimes has its downturns, such as during pandemics and wars, it later recovers and continues its upward pace.

If every time the stock market goes down, you run out to sell your shares and when it’s up you buy again, eventually you’re going to lose your savings, because you’re not going to increase your capital if you sell your shares at a lower price and buy at a higher price. Stay calm as the market will eventually stabilize.

2. Assess your risk tolerance

Risk can be defined as the possibility of losing money on your investment.

Risk tolerance is defined as how much loss a person can tolerate before feeling the need to sell their investment.

There are several factors that can influence your risk tolerance, such as age, the purpose of the investment if you have other purposes besides retirement, and of course, your personality.

Usually, a younger person may have a higher tolerance for risk, as they will have more time to recover if an investment performs poorly and they have many years left until retirement. An older person may want to take less risk as they approach retirement age. Likewise, a more adventurous and risk-taking person is likely to have a higher risk tolerance than a conservative person.

You must evaluate what your tolerance for risk is in order to decide what type of investments you should make.

3. Maintain a diversified investment portfolio

Your investment portfolio is the collection of assets that you have. For example, if you have aggressive mutual funds, balanced mutual funds, and conservative-aggressive mutual funds, you have a diversified investment portfolio. This is a portfolio made up of different assets, which reduces risk.

Assets can be low, moderate, and high risk. By having a diversified portfolio, you have assets that you can make more money with, but you also have assets that are more stable.

Likewise, if you invest in the stock market, you should maintain a diversified portfolio in various sectors (examples: technology, telecommunications, health). It is impossible to predict which sectors are going to grow in value and which are going to decline, therefore by having investments in various sectors you minimize the possibility of loss.

4. Focus on your goals

Instead of concentrating on short-term situations, you should focus on your long-term goals and build your financial planning on that basis. Depending on what your financial goals are, time, and your tolerance for risk, you must decide the type of investments you want to make.

That does not mean that your investments should always stay the same, because your financial goals and particular situations may change, but once you establish your financial goals, invest according to them, and evaluate them over time and adjust conforming to your needs.

5. Seek advice to invest your money

Most people do not have the proper knowledge to invest their money. The purpose of making investments is to grow your money, therefore, if you do not have the proper knowledge, it is recommended that you seek an expert to help you invest properly. There are professionals who have vast experience in the field of investments, and although it may cost you, you get the right advice to make better use of your investments and grow your money.

If you want more information about retirement plans, at Oriental we are more than ready to serve you, click here: 401K Plan | Oriental Bank.