Background:

The Direct Buyer Assistance Program, hereinafter referred to as the Program, is administered by the Housing Financing Authority (HFA) through a $295,000,000.00 grant to cover down payments and closing costs in residential property transactions. It is aimed at low and moderate-income buyers in urgent need of housing.

This HFA program works in conjunction with various financial institutions, such as Oriental Bank. However, the final determination of eligibility lies with the HFA.

Use of Funds

- Up to 100% of the down payment

Assistance to cover closing costs and down payments are provided through a second silent mortgage without payment terms, up to a maximum of:

- $45,000 per eligible property transaction under the program

- $55,000 per eligible property transaction in which the buyer is an Essential Recovery Personnel or “Critical Recovery Workforce (CRW/First Responder).”

- To identify eligible workers, access the list here.

- An additional incentive of $5,000 is available for families interested in purchasing a property in a designated urban area identified by the program.

- To validate if the property is located in an urban center, as defined by the Program, identify the eligible urban centers for additional assistance through these links. The map delineates urban core areas.

Program Requirements

The HFA subscriber will assess the borrower’s ability to make monthly mortgage payments and the long-term financial viability of the purchase. The subscriber will evaluate the debt-to-income ratio and calculate the amount of subsidy required to reduce this ratio as close to thirty-six percent (36%) as possible.

Eligibility Determination

- You must not own a property at the time of applying for assistance.

- U.S. citizens of legal age to contract or individuals with legal residence in the United States.

- The household income must not exceed 120% of the median income limit as established by HUD. Refer to the income table included below.

- Eligible properties.

Approval Conditions

The approval of the loan application is subject to the applicant’s capacity and ability to assume the payment of a mortgage and the property used as collateral for the loan.

Loan Terms

- Fixed interest rate

- 30 years

- Balloon loans or variable interest loans are not eligible

Closing Costs

The Program may cover reasonable and customary closing costs, including, but not limited to, credit report, property appraisal, loan origination fees, escrow funds, recording, notary fees, title transfer fees, title insurance, title searches, or similar costs for LMI (Low to Moderate Income) buyers.

Closing costs are regulated by the Consumer Financial Protection Bureau

The Closing Disclosure details the charges that a borrower must pay as part of the closing process. These costs have zero tolerance or a ten percent (10%) tolerance for changes. Normally, these costs range from three to six percent (3-6%) of the purchase price. Because these costs are strictly regulated, the HFA will consider closing costs reasonable as long as they comply with the Qualified Mortgage Rule and applicable mortgage regulatory guidelines.

Ineligible Uses of Program Funds

- Past-due property tax payments (CRIM)

- Expenses typically paid by the seller but agreed to be covered by the buyer, for example, legal fees, stamps, and mortgage cancellation receipts

- Cancellation of existing mortgages

- Debt cancellation to make the transaction feasible, among others

Property Use

The property must be the primary residence of the buyer applicants and/or their family members.

Types of Loans

- Federal Housing Administration (FHA)

- USDA/Rural Development

- Veteran Affairs (VA)

- Conventional FNMA Compliant with a CLTV of up to 97% with private mortgage insurance (MGIC)

Sale Price Limit

The sale price of the property must not exceed the limits of the FHA loan or the appraised value, whichever is less. The sale price cannot be higher than the appraised value.

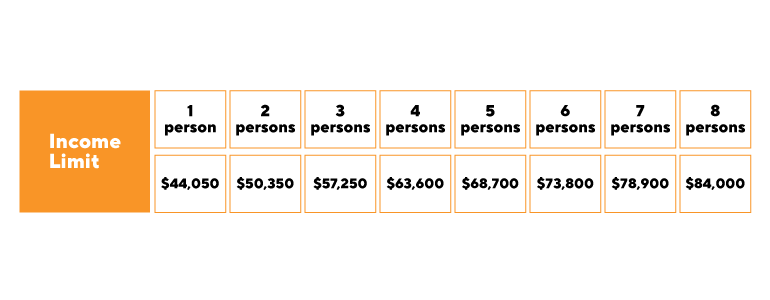

Income Limit

For purposes of calculating the income limit of the program, the income of all those over 18 years of age who are members of the family composition who will live in the property will be considered.

The table of Income Limits for all areas of Puerto Rico for Fiscal Year 2021 Adjusted by the Federal Poverty Guide is included.

Property Eligibility Requirements

- Residential properties with 1 to 2 housing units. This can include houses, apartments, townhouses, and row houses.

- The property must be ready for occupancy.

- Applicants will be allowed to purchase homes that require minor repairs, as long as the following criteria are met:

- Program funds will not be used for repairs.

- Repairs and improvements are covered under the applicant’s mortgage.

- Repairs and improvements are limited to those identified in the property appraisal report.

- The required improvements are not structural and do not exceed $35,000.

- If it is a new project, a use permit must be obtained.

- All properties built on or before 1978 require a lead inspection. If the buyer requests it, sellers must provide home buyers with a ten (10) day period to conduct a paint inspection or risk assessment. (Buyers have the option to indicate that they do not wish to conduct this inspection in the Lead Base Paint Hazard HUD Disclosure). If the applicant decides to conduct the inspection and the property is found to have led, it is disqualified from the Program.

- If the property in the environmental assessment is determined to be ineligible, it must be determined to be in a flood zone for it to be reconsidered, and a certification that is not in a flood zone or a Letter of Map Amendment (LOMA) is required.

- It must comply with the environmental assessment conducted by the Department of Housing.

- It must meet the Minimum Property Requirements (MPR) for existing properties or Minimum Property Standards (MPS) for new homes, as defined by HUD and loan collateral requirements.

Ineligible Properties for the Program

- Properties located in flood-prone areas (Special Flood Hazard Areas).

- Properties are located in coastal barrier areas.

- At the discretion of the HFA, exceptions may be granted for properties built near airports.

Loan to value

Based on the maximum for the type of loan requested. The Program constitutes a second mortgage for the amount of program assistance. The maximum combined loan-to-value (CLTV) will depend on the type of loan product being requested.

Financial Counseling Requirement

The Program requires that all participants/buyers complete an eight (8) hour financial education counseling course for homebuyers or CDBG-DR Housing Counseling Program before the loan application submission date. The participant receives a counseling certificate valid for one (1) year.

The link to the names and contact information of HUD-certified institutions that provide financial counseling services is included.

Mortgage Insurance or Guarantee.

Based on LTV/CLTV and the type of mortgage product

Duplication of Benefits

It is prohibited for an individual to receive federal funds when they have received financial assistance under other programs, whether from private insurance, charitable institutions, or other local, state, or federal programs. Examples of such assistance include risk insurance payments or flood insurance payments for claims resulting from hurricanes Irma and María, assistance for the rehabilitation or replacement of a residential property, and funds guaranteed by the Small Business Administration (SBA), among other types of aid.

If the applicant/buyer has received any of these forms of assistance, the amount received must be subtracted from the Program’s assistance. This verification is conducted by the Housing Department as part of the eligibility evaluation process.

Restrictive Conditions

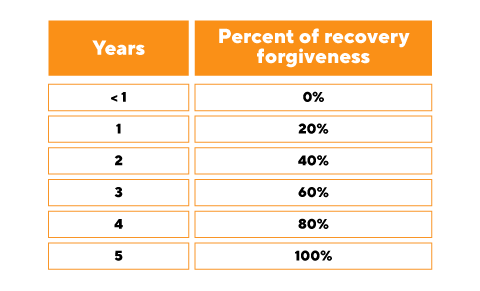

- Buyers must use the property as their primary residence for a period of no less than five (5) years from the date of purchase.

- In the event of a property sale, the transaction will require authorization from the HFA and is subject to the recovery of assistance.

- The recovery of Program assistance is proportional to the time the property is occupied as the primary residence. The sale, refinancing, leasing, or mortgage foreclosure is subject to the recovery of Program assistance according to this table:

There are exceptions in which the HFA may waive the recovery of Program assistance with prior authorization:

- Change in the household’s financial circumstances.

- Death of a co-borrower/co-debtor.

- Permanent or long-term illness or disability of a borrower or dependent.

- Divorce or legal separation of one of the borrowers.

- Relocation due to job transfer or relocation to a location that is more than (50) miles away from the borrower’s current primary residence to be closer to work.

After completing the application process through the website, the HFA will conduct the evaluation and determine the final amount of assistance for both the down payment and closing costs.

Frequently Asked Questions

Regarding eligibility requirements:

| P: | Is it a requirement for the customer to have a loan number to participate in the Financial Counseling Sessions? |

| R: | No, but to provide you with assistance, you must take the Financial Counseling course. The course lasts approximately 6 to 8 hours. Appointments can be scheduled over the phone or online, and the course can be taken online or in person. It is recommended to contact one of the agencies directly. The certificate is valid for one year and is completely free. |

Regarding the property:

| P: | A house with a swimming pool, would it qualify? |

| R: | It is acceptable as long as it is in good condition (full and functioning equipment). It is not a condition that invalidates the collateral. |

| P: | What if the property does not have utilities connected? |

| R: | A certification from a master plumber and electrician (as applicable) must be provided. If the utilities have been connected within the past year, evidence of connection (invoice) must be provided. |

| P: | The property has two units, are they accepted? |

| R: | The program allows for two units, but in those cases, there are two inspections. When submitting the case to housing, the appraisal and the inspection must align. |

Do you meet the program requirements? If so, here are the next steps:

1. Apply for a Prequalification Letter for a mortgage loan. Prequalify here.

2. Take the required Housing Counseling Program course. Access the course here.

3. Make an offer to purchase a property and apply for a mortgage loan.