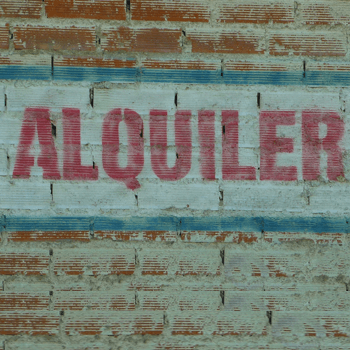

The decision to own a home or rent a property is usually a determination that will depend on the lifestyle you want to have or the economic situation you are in at the time of purchase.

Most mortgage banking experts agree that, when analyzing long-term plans, home ownership is the main concern for people.

Buying a house has many advantages over renting a place. Therefore, there are several facts that place purchasing as a great option beyond providing a sense of belonging and security:

When you buy a property, you have the right to make all the improvements you want.

It is synonymous to an investment that, if done correctly, is for life. Furthermore, it offers stability in your future and that of your family.

The taxes and interest you pay on the residence can be deducted on your income tax return.

You avoid the pressure and instability of renewing contracts and increases in monthly payments that are very common in rentals.

Currently, the offers that the market gives you in terms of financing, makes your payment (in most cases) less than the rent payment.

You will be able to benefit from government, federal, municipal and state incentive programs created to subsidize the financing of your primary residence.

Don’t forget that the first step before buying a home is an interview with your mortgage banker to make sure this is the ideal time to buy. The representative will give you several “tips” so that you know first hand your payment capacity and financing alternatives for which you qualify, taking into account your credit score.

On the other hand, in the stage in which you are just beginning to build your life (becoming independent, living with your partner or the sudden arrival of a child), renting a property is the quintessential alternative. Some advantages:

No strings attached. Renting a property gives you the opportunity to evaluate and get to know the area where you live. If you don’t like it, you have the facility to change places as many times as you wish.

Easy space management. Since you can change your home whenever you want, adjusting the space is much easier. Setting aside a room for the baby and bringing the office into the house are examples of this.

Professional expansion. Surely you are thinking that one thing has nothing to do with the other. The truth is that it does; they are inextricably linked. For example, if the opportunity arises to go abroad to work, all you will have to do is cancel the lease without the need to feel tied to a home.

Money saving. Owning a home involves paying taxes. If it is a housing development, maintenance costs must be included. These expenses might easily add up to over a thousand dollars. In a rented property you will not have to pay any of the expenses previously mentioned and it is money you can spare for other things.

Finally, the time has come to make a decision. To buy or to rent? Keep in mind that there is no right or wrong option. It all depends on the stage and needs of each person. If you’re ready to take the next step and get your mortgage, here’s a guide on how to prepare for the purchase of your first home.