Many people dream of being able to buy a property, to have the security of a home for their family, to have a house or apartment that they can fix up to their liking, or to be able to use it as an investment. However, buying a property requires preparation on the buyer’s end. This guide will help you navigate through the entire purchase process with ease and confidence.

Are you ready to buy your house?

In this guide, we share a list of all the expenses and obligations that you must consider when applying for a mortgage loan. To evaluate the expenses and obligations that need to be considered during your mortgage loan qualification process, you must identify all the obligations that you have where you need to make a timely or periodic payment. Also, you must remember that all those debts where you are a debtor or co-debtor will be considered expenses during the process.

In the same way, when you are reporting an income, you must make sure that you can present evidence of this income and the potential recurrence of it. Therefore, it should not be a temporary income or a non-recurring income.

- Employment: Having permanent employment is essential when applying for your loan. This is one of the determining factors when applying for a mortgage. When evaluating your application, the mortgage institution will verify if you have had the same job for two or more years or if your line of work has been the same during this period. The employer will be asked to verify your employment, and if you work through professional service contracts, you must provide a copy of the contract(s).

- Debts: The total sum of the monthly payments you make on your current debts should not exceed 28% of your income, excluding the mortgage payment. If you include the mortgage payment, it should not exceed 43%. Some of the debts that you should consider are personal loans, car loans, and credit cards, among others.

- Income: If you are a salaried person, you must keep evidence of your payroll stubs, and if you are self-employed or work through professional service contracts, you must present your certified tax returns for the last 2 years to prove your income.

- Credit history: For all financial and mortgage transactions, the credit score is the most important factor in achieving the desired approval and getting the best conditions for the closing offers. Your credit history represents your debts and how you have paid them. Keeping evidence of your payments for water, electricity, and telephone services can serve as alternate evidence of your payment history. The same applies to your rent payment if you live in a rented property. A credit report will be requested from a credit bureau to verify your credit score and check any delays in debt payments. If someone else is going to be included in the mortgage loan, that person’s debts, how they are paid, and their credit score will also be considered. To qualify, the lowest score of the two applicants will be considered.

- Prequalification: A prequalification is a preliminary assessment of your income and expenses, based on the information you provide. The advantage of conducting a prequalification is that it allows you to know the amount for which you can apply for the loan, which will save you time searching for the property you want and will help you choose a house that fits your financial reality. We invite you to visit our website to carry out your prequalification.

- Savings: Subsequently, the client will receive a good faith estimate, with the terms and conditions of the loan and a breakdown of the monthly costs, the down payment, and the closing costs. It is important to emphasize that during the mortgage loan application process, the information offered by the client will be validated through documentation. You must prove that you have the money for the down payment and closing costs. You can request your preliminary estimate at our website.

- Property appraisal: The property will be the collateral for the requested loan, so an appraisal must be made to determine its value. To establish the maximum amount of the loan, the sales price or appraised value, whichever is less, will always be used as the basis. The appraisal is carried out by a certified appraiser selected by the bank. In addition to establishing the value of the property, the appraisal tells us if the property needs repairs to put it in optimal condition.

How to apply for a mortgage loan?

To apply for a mortgage loan with Oriental, you have several alternatives.

- Access our website or contact 787.777.2272.

- Visit one of our branches conveniently located throughout the island.

- Additionally, you can make an appointment and one of our executives can visit you at your home or workplace. The mortgage officer in charge of your case will explain the entire procedure, from the application to the closing of your mortgage loan.

How to evaluate the mortgage offers: In the case of a sale, the loan amount is determined by the sale price of the property or the value of the appraisal, whichever is less. In addition, each product lends up to a maximum amount, which is calculated by the lowest number of these two amounts. For example:

- FHA: 96.75%

- Veterans: 100%

- Rural: 100%

- Conventional compliant: 97%, with mortgage insurance

The difference between the amount you can borrow for each product and the lowest amount between the sale price and appraisal must be paid by the customer who will buy. This is known as a “down payment.”

In addition, when evaluating an offer, you should consider that offers with lower interest rates will have higher origination costs and discounts, which translates into money that you will have to contribute as part of the closing costs. Higher rate offers have lower origination fees and discounts, and some don’t even have origination costs.

On the other hand, those offers with a lower interest rate will have a lower monthly payment. You will pay less interest during the life of the loan, while those with a higher interest rate will have higher payments, and you will pay more interest during the life of the loan.

In conclusion, when selecting the offer, you must consider how much money you have or will need to cover the down payment and closing costs and the amount of the payment you want to make.

Required documents

The documents that you must provide to the bank at the time of origination of a mortgage loan are:

- Property deed with the legal description and presentation data

- Payroll stubs covering the last 30 days

- Withholding vouchers [form W-2] for the last 2 years

- Bank statements for the last 2 months

- Purchase Option Contract [if applicable] [si aplica]

- Evidence of payment of option to Seller [if applicable] [si aplica]

- Certified tax returns for the last 2 years, for self-employed applicants

- 28% of the gross monthly income should be enough to cover the monthly payment of the new mortgage. Generally, these are the parameters considered to qualify the applicant’s income. Still, these may vary depending on the product and the circumstances of the case.

- 43% of gross monthly income should be enough to cover the monthly mortgage payment plus other monthly debts. At the bank’s discretion, debts that will be canceled within the next ten months will be taken into consideration, as long as they are not revolving accounts, nor current expenses for water, electricity, telephone, school, and groceries. Payroll deductions are excluded.

- Among other documents

After applying for your loan, what’s next?

After completing your application, all the information related to your income, debts, and employment will be processed and validated.

Once the loan is approved, a closing officer will contact you to provide you with the final information and coordinate the closing date. The legal status of the property is verified in the Property Registry, as well as if taxes on the property are owed to the CRIM and/or the Department of the Treasury. The responsibility of the bank is to deliver the property free of liens.

Once the loan is approved, a closing officer will contact you to provide you with the final information and coordinate the closing date.

If your request is not approved, you will receive a letter from the bank stating the reasons why it was denied. We recommend that you contact your bank officer to inform you of the reasons.

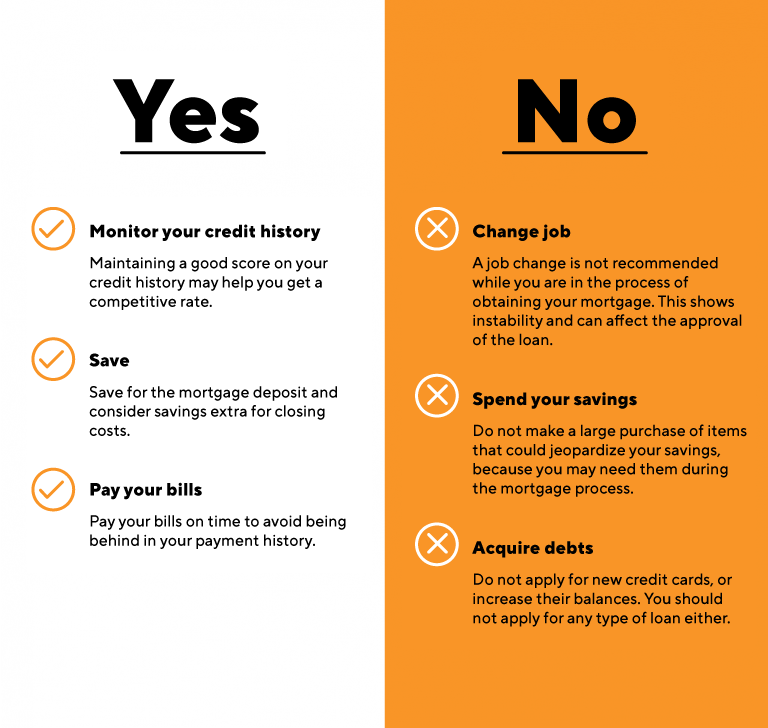

Dos & Don’ts When Buying a House